Demystifying FEMA: What Enterprises Need to Know About Cross-Border Compliance

If you're an Indian business eyeing global markets, or a fintech enthusiast trying to decode the maze of cross-border payments, you've probably heard of FEMA. But what exactly is it, and why does it matter so much?

We will break it down in our step by step blog post so you get the most out of understanding this increasingly interesting topic.

What is FEMA, and Why Should You Care?

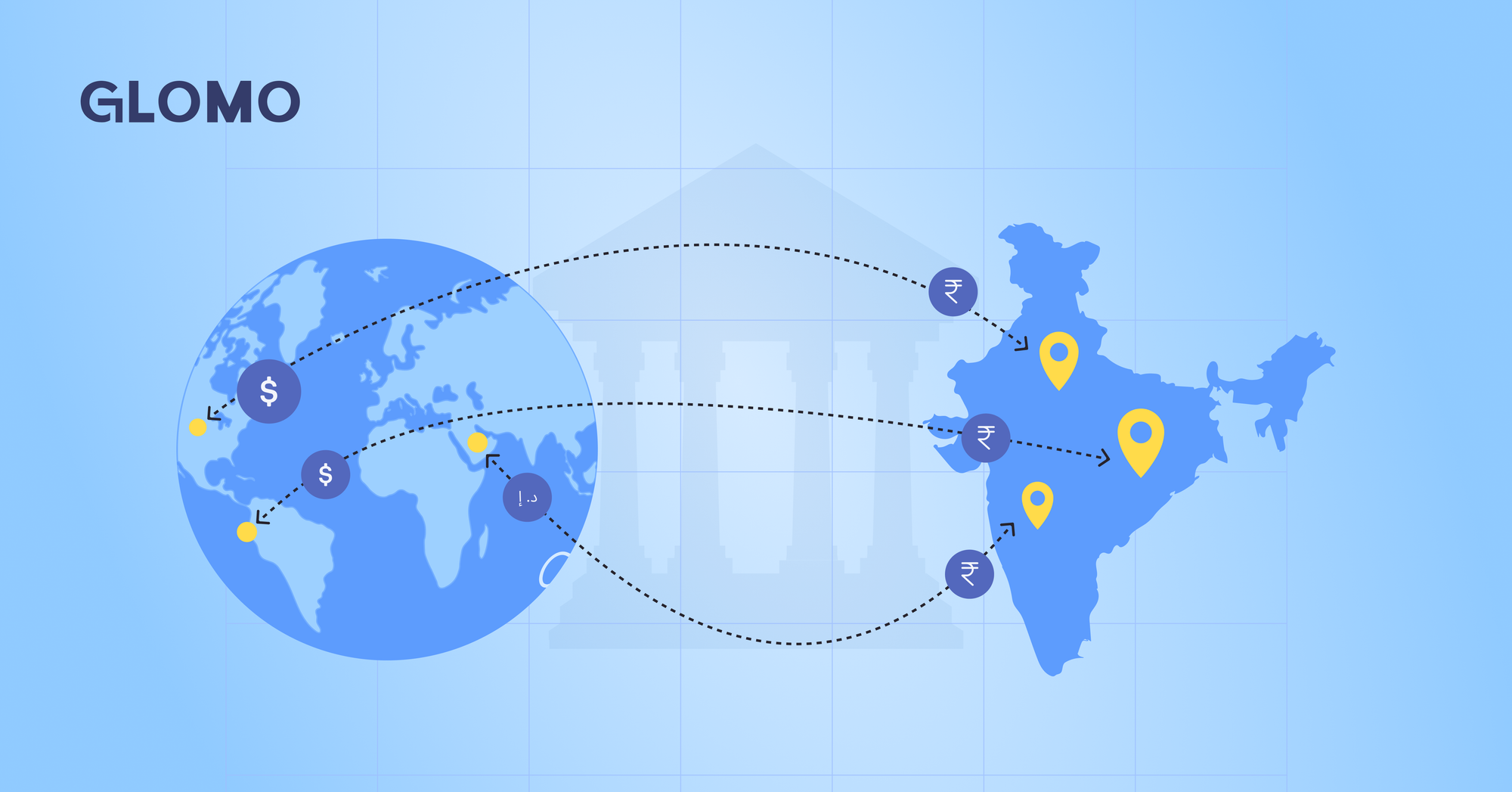

FEMA stands for the Foreign Exchange Management Act, a law that governs how money moves in and out of India. Think of it as the rulebook for all cross-border financial activity, so when you send money abroad, receive foreign investment, or pay an overseas vendor, it would impact all these transactions.

For Indian enterprises, especially those in fintech or global trade, FEMA is not just a regulation, it’s the foundation of how you operate internationally. And if you're not compliant, you're not just risking penalties, you’re risking your global ambitions.

The New-Age FEMA: What’s Changed Recently?

Over the past couple of years, FEMA has undergone a quiet but powerful transformation. The Reserve Bank of India (RBI) has been steadily liberalizing rules to make cross-border transactions smoother and more business-friendly.

Here are some key updates you should know:

- INR Goes Global: Indian exporters can now settle trade in Indian Rupees with countries like the UAE and Indonesia. This is a big shift from the earlier dollar-dominated system, where most international trade had to be routed through USD or other major currencies. By enabling INR settlements, India is not only reducing its dependence on foreign exchange reserves but also strengthening the rupee’s position in global trade. For businesses, this means fewer currency conversion losses and faster settlements.

- Special Rupee Vostro Accounts (SRVAs): SRVAs allow foreign banks to open and maintain INR accounts with Indian banks. This enables Indian exporters to receive payments in rupees, even when dealing with foreign buyers. For example, if an Indian textile exporter sells goods to a buyer in the UAE, the UAE bank can use its SRVA with an Indian bank to pay the exporter in INR. This eliminates the need for dollar conversions and makes trade more efficient and cost-effective. It’s a win-win for both sides, simpler for the buyer, smoother for the seller.

- Foreign Currency Accounts Abroad: Indian exporters are now permitted to open and maintain foreign currency accounts outside India. This gives them greater flexibility in managing overseas operations, paying local vendors, or reinvesting earnings without the need to repatriate funds immediately. It’s particularly useful for businesses with global supply chains or subsidiaries abroad, as it reduces friction in cross-border cash flow management.

- Simplified FDI Rules: FEMA amendments have made it easier for Indian startups and enterprises to raise capital from foreign investors. Cross-border share swaps, where equity is exchanged between Indian and foreign entities, have been streamlined, and approval processes have been relaxed. This is a big boost for Indian fintechs and startups looking to scale globally, as it opens up more avenues for strategic partnerships and funding.

Compliance 101: What Enterprises Need to Get Right

Navigating FEMA isn’t just about knowing the rules but also about applying them correctly. Here’s what Indian businesses need to keep in mind:

- Use the Right Channels: All cross-border transactions must go through RBI-authorized banks (called AD banks). Avoid informal routes, they’re not just risky, they’re illegal.

- Know Your Transaction Type: FEMA distinguishes between current account transactions (like trade payments, remittances) and capital account transactions (like FDI, loans, investments). Each has its own set of rules.

- Documentation is Key: Every transaction must be backed by proper paperwork—contracts, invoices, declarations. Missing documents can delay or even invalidate your transaction.

- Stay on Top of Reporting: Delays in reporting foreign investments or earnings can lead to penalties. FEMA compliance is not a one-time thing, it’s an ongoing process.

Why GIFT City is a Game-Changer

Here’s where Glomo comes in.

Glomo operates out of GIFT City, India’s first International Financial Services Centre (IFSC). This isn’t just a fancy address, it’s a strategic advantage.

GIFT City offers:

- Relaxed FEMA norms for entities operating within the IFSC.

- Tax incentives and faster regulatory approvals.

- A regulatory sandbox for fintech innovation.

- Direct access to global financial markets without the usual red tape.

For enterprises, this means faster, cheaper, and more compliant cross-border payments. For fintechs, it’s a launchpad to build globally relevant solutions.

Avoiding Common Pitfalls

Even with liberalized rules, many businesses trip up on the basics. Here are a few common mistakes and how to avoid them:

- Misclassifying transactions (e.g., treating a capital account transaction as a current one).

- Using non-authorized channels for remittances.

- Ignoring repatriation timelines for export earnings.

- Not maintaining proper KYC/AML records.

The good news? With the right partner, you don’t have to worry about any of this.

How Glomo Helps You Stay Compliant and Confident

At Glomo, we don’t just move money, we move it smartly, securely, and in full compliance with FEMA and RBI guidelines. Whether you're an enterprise scaling globally or a fintech building the next big thing, we help you:

- Navigate FEMA with ease.

- Leverage GIFT City’s regulatory advantages.

- Ensure every transaction is audit-ready.

- Focus on growth, not paperwork.

Final Thoughts

FEMA might sound like a bureaucratic hurdle, but in reality, it’s a framework designed to protect and empower Indian businesses going global. With the right knowledge and the right partner—you can turn compliance into a competitive edge.

Ready to simplify your cross-border payments? Let Glomo show you how.