Glomo at GFF: Building a Compliance-First Financial Infrastructure for the World

Glomo's vision, shared at GFF: We are the first IFSCA-regulated PSP building for Bharat and scaling a compliant global financial network for the world.

This year’s Global Fintech Fest (GFF) was a landmark for Glomo Payments, where we presented our vision of a compliance-first financial infrastructure built from Bharat for the world, setting the benchmark for the next generation of cross-border payments.

We believe that innovation in finance can only be truly sustainable when it is anchored in strong compliance foundations. At GFF, we had the opportunity to share how our team is bringing this belief to life through a licensed, technology-driven platform operating from GIFT City. When I entered the city of Mumbai, I observed the billboard of Prime Minister Starmer’s and Prime Minister Modi’s visit with the Gateway of India in the backdrop. But GIFT City is the true gateway of foreign exchange flowing into the country, and it is now getting renewed de novo.

For those who attended the Hon’ble Finance Minister’s Keynote Speech on the first day of GFF can appreciate the importance of GIFT. It is India’s first designated financial zone that enables global financial institutions to operate in foreign currency under a special regulatory, tax, and business framework. GIFT City as of last quarter saw a transaction flow of 140+ Billion USD. And that’s one of the key markets we are providing the financial infrastructure for!

India’s First IFSCA-Regulated Payment Service Provider

Glomo is the first Payment Service Provider licensed and regulated by the International Financial Services Centres Authority (IFSCA) at GIFT IFSC.

This license enables us to:

- Issue multi-currency payment accounts

- Facilitate cross-border money transfers

- Offer store-of-value payment account services to merchants

As a regulated entity, we adhere to AML, CFT, and KYC guidelines under IFSCA and India’s PMLA, aligning our framework with FATF global standards. Every transaction processed through Glomo undergoes real-time compliance screening, ensuring both speed and integrity.

The People Behind the Platform

Glomo was built by a team of industry veterans with a collective experience of over 100 years across some of the world’s leading payments and fintech companies; and systematically important banks from India and globally .

This combination of deep operational expertise and visionary support allows us to build a modern global financial infrastructure that balances regulatory precision with technological agility.

Partnerships that Power Global Financial Flows

Over the past year, we have built strategic partnerships with leading banks, fintechs, and payment networks to strengthen our compliance-first financial value chain.

Through collaborations with the top Indian and global bank and other global partners and network providers, Glomo supports major sectors such as:

- Insurance, by powering premium collection and settlement across payment corridors

- Capital Markets, by enabling Liberalised Remittance Scheme (LRS) transactions for overseas investments

- Exporters, by facilitating local collections and compliant cross-border payouts

These partnerships reflect our commitment to building a payment ecosystem that is secure, efficient, and globally interoperable.

Redefining Payments Through Simplicity and Compliance

Our product suite is designed to make global payments as seamless as possible without ever compromising on compliance.

- Multi-Currency Accounts: Receive, hold, and convert balances across 10+ currencies through transparent pricing and local clearing systems.

- Embedded Checkout and Payment Links: Collect payments via cards, bank transfers, and open banking, with built-in compliance that automatically manages declarations and KYC documentation.

- Instant Settlements: Powered by our internal liquidity management system, ensuring instant fund disbursement and eliminating the delays of traditional remittance models.

Enabling India’s LRS Flows at Scale

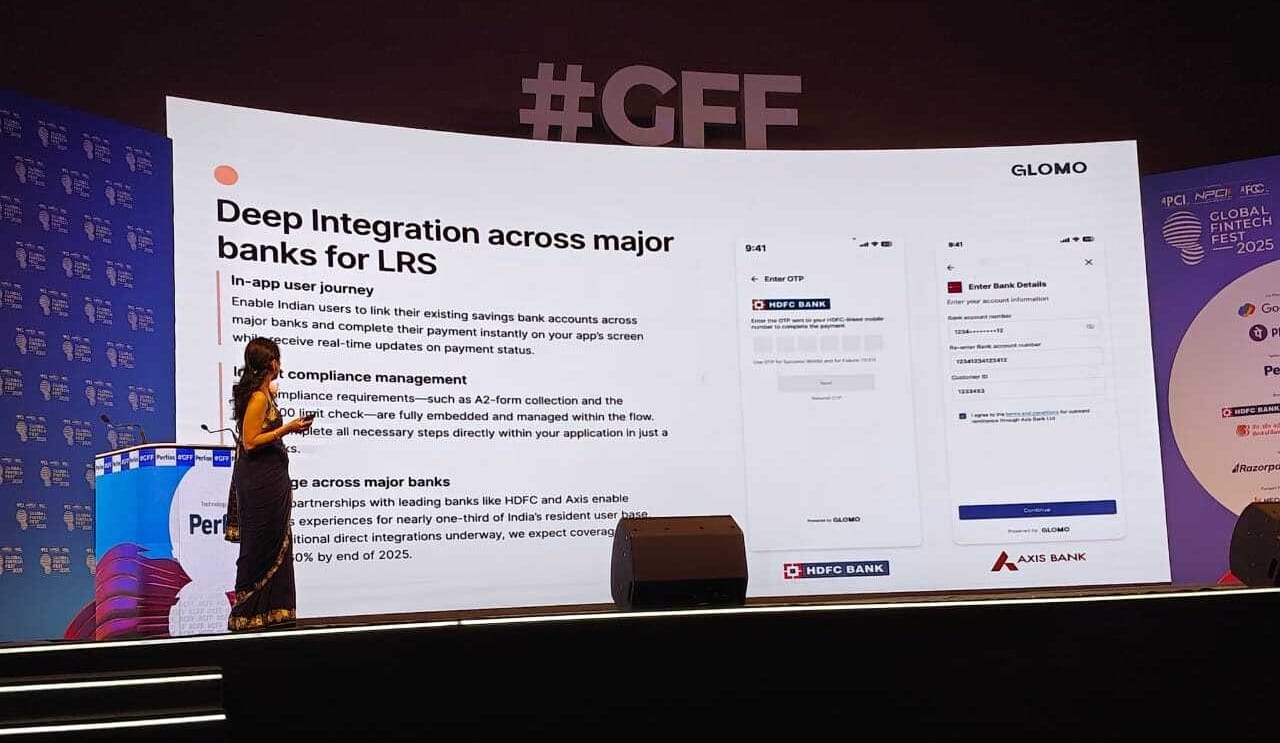

We have deep integration with two of the Systematically Important Banks for LRS payments.

Through in-app journeys, users can link their savings bank accounts with partner banks directly within merchant applications, complete transactions instantly, and automatically fulfil Form A2 and USD 250,000 limit checks.

With our current integrations covering nearly one-third of India’s retail banking base, and ongoing partnerships to expand further, we aim to achieve 60% coverage by end-2025.

It is a step toward making cross-border payments more accessible, compliant, and digital the way they were meant to be.

Global Reach Through Local Payment Rails

Glomo’s infrastructure supports real-time local collection and payout capabilities across major financial corridors worldwide.

Why Glomo

We built Glomo around three core values Speed, Compliance, and Cost Efficiency.

Our platform enables businesses to:

- Go live in less than two weeks

- Onboard customers in under three hours

- Maintain a 99% straight-through processing (STP) rate

- Access 24-hour SLA support

- Ensure end-to-end fraud, AML, sanctions, and PEP screening for every transaction

This is not just infrastructure, it is a compliance-first network built for the next era of global commerce.

Building for Bharat, Scaling for the World

As we concluded our presentation at GFF, we reflected on how India is transforming into a global payments powerhouse.

At Glomo, we are building from Bharat a world-class, compliant financial infrastructure that operates with global standards but is rooted in Indian resilience and ingenuity.

Our goal is simple yet powerful: to move money securely, transparently, and compliantly while building trust in every transaction.